What’s on your financial institutions’ wish list?

- A loan decision engine powered by artificial intelligence that enables seamless and accurate automation of your financial institutions’ loan processes.

- A fully featured, multi-platform mobile banking application that enables your customers to perform banking transactions anytime, anywhere.

- An industry-leading SaaS core banking solution featuring flexible user-customisation, limitless third-party integrations, automations and powered by artificial intelligence.

If your answer is yes to all of the above, you’re not alone.

The financial services landscape has changed dramatically over the years and it is almost impossible for any financial institutions to keep pace with competition without leveraging on digital technologies to compete.

In the article, we will look at why the financial services industry is moving rapidly forward with digitalisation and the implications of Digital Transformation on financial institutions.

What is Digital Transformation?

Digital Transformation is the adoption of digital technologies to transform your existing services or business operations. However, don’t be mistaken into thinking that it is just a technological upgrade. Digital transformation involves a cultural change that challenges long-standing business processes and re-evaluation of all aspects of organisation.

The Need for Digital Transformation

1. Capitalising on Undiscovered Opportunities and Insights

A recent Global AI in Financial Services Survey revealed that more and more financial institutions are leveraging on Artificial Intelligence (AI) enabled data analytics to create new revenue opportunities and make better informed business decisions. It is clear that financial institutions without any form AI implementation would lagging behind the competition.

With the help of AI, financial institutions are able to build new value propositions based on the new insights drawn from previously undiscovered data. These new insights would in turn give financial institutions informational advantages to make market forecasts and informed business decision.

2. Address Changing Customer Needs

Rapid modernisation, coupled with unprecedented level of disruptions caused by the COVID-19 pandemic, has resulted in a shift in today’s financial consumer habits and expectations. They are no longer satisfied with traditional ways of banking and are demanding for convenient, on-demand access to financial services and more personalised customer experience from their financial service providers.

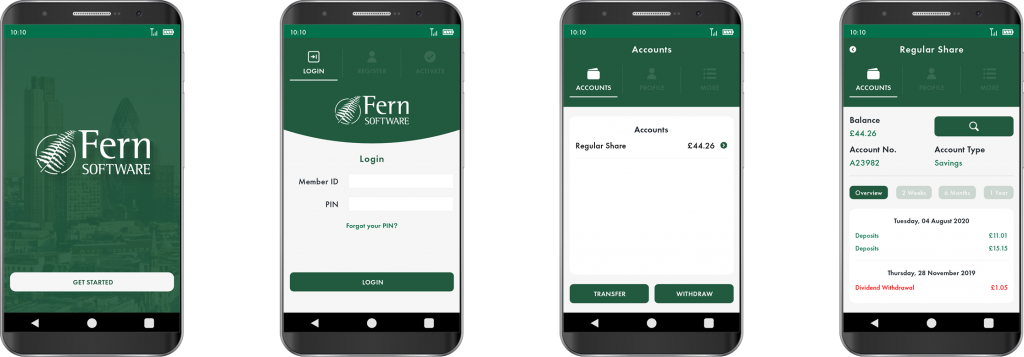

To meet their customers’ needs, financial institutions need to move quickly to bring their services online and digitalise their customer service. Financial institutions have started to introduce their own online/mobile banking application for 24/7 access and implemented self-serve, interactive chatbots to handle customer enquiries

3. Operational Cost Reduction and Efficiency

For years, the traditional way of banking revolves around interactions with customers within physical branch networks, but it all came to an abrupt halt as the world is forced to reckon with the economic impact of a global shutdown. Financial institutions have turned to digitisation for agility and better resource optimisation.

In our previous blog article, we have examined how financial institutions are implementing artificial intelligence technologies into their workflow to achieve significant cost reduction and improvement in their operational efficiency.

The right implementation of artificial intelligence technologies can reduce overhead costs by removing unnecessary manual interactions. This means faster turnaround and your financial institution can grow and expand with the same or less resources.

Never Too Late for Digital Transformation

All successful digital transformations begin a clear goal, be it addressing to

the changing needs of your customer or increasing operational productivity, and with the support of every member of the organisation.

It is never too late to start and as the saying goes digital transformation is a journey, not a destination. It involves an evolution of improvements and refinements over time.

Where Do I Start?

Fern Software is an international SaaS FinTech Solutions provider incorporated in 1979 with a global presence with over 300 sites in 50+ countries. We specialise in providing Core Banking Systems and Digital Transformation Services to financial institutions and our Fern Software solutions can help kickstart your digital transformation.

Quantum AI, Fern Software’s Loan Decision Engine powered by Salesforce Einstein AI technologies that can rapidly and accurately determine loan decisions for any financial institution.

Baytree, Fern Software’s SaaS Core Banking solution built on the native Salesforce Lightning platform featuring industry-leading solution for lending, portfolio management and customer success.

Fern Mobile App, Fern Software’s fully featured, fully customisable multi-platform mobile banking application for financial institutions looking to go mobile.

It is time to kickstart your digital transformation, get in touch with us to learn how Fern Software Solutions can help your financial institution with your digital transformation.