Artificial Intelligence (AI) has come a long way since the term was coined way back in 1955. Fast forward to the present day, AI has become an integral part of our daily lives and the financial services industry relies on AI to stay one step ahead of the curve.

In this article, we will take a look at how artificial intelligence is changing the financial services industry and shaping the future for financial institutions.

What is Artificial Intelligence?

In essence, Artificial Intelligence is a broad branch of computer science that uses algorithms and technologies to enable computers and machines to emulate or recreate the capabilities of the human mind.

Adoption and Impact of Artificial Intelligence

A recent Global AI in Financial Services Survey research published by the Cambridge Centre for Alternative Finance (CCAF) in January 2020, revealed that a majority (85%) of the financial institutions are currently using some forms of artificial intelligence with Risk Management (56%) being one of the most common area of usage followed by generation of new revenue (52%). The most common use case for financial institutions is leveraging AI technologies to enhance their existing products.

With such a high adoption rate of AI within the financial services industry, financial institutions are expecting AI to become a significant business driver in the near future and opting to adopt the use of AI to attain cost and operation efficiency through automation.

Artificial Intelligence for Your Financial Institution

Many financial institutions are looking to implement artificial intelligence into their credit decision process as it provides a faster and more accurate assessment of a potential borrower. There are many options out there but not all solutions are created equal.

Quantum AI Loan Decision Engine

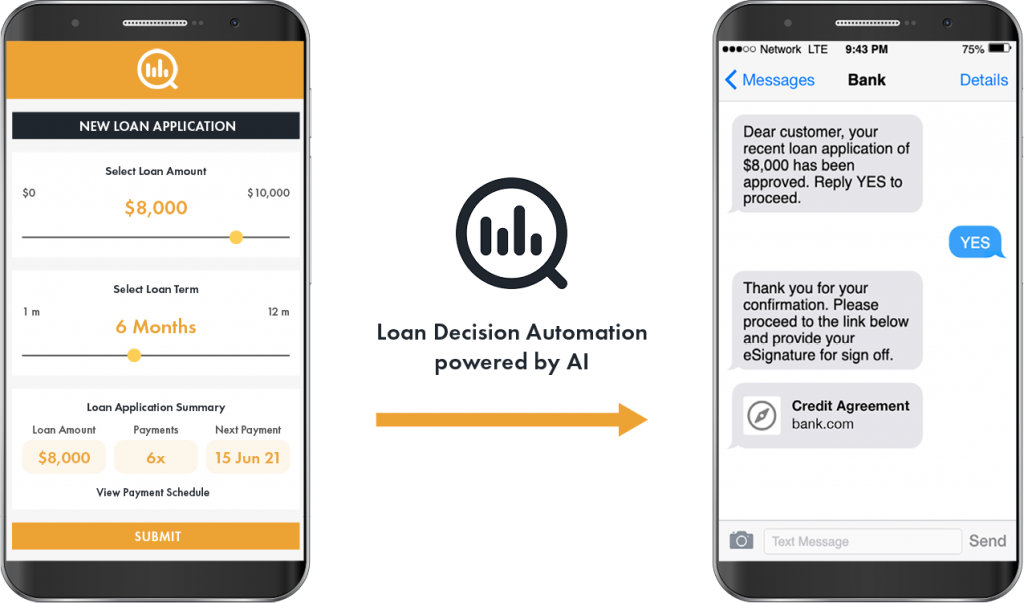

Quantum AI, Fern Software’s latest core agnostic Loan Decision Engine powered by Salesforce Einstein AI technologies that can rapidly and accurately determine loan decisions for any financial institution. It utilises the financial institutions customer loan portfolio book and supporting financial services inputs from Open Banking & Credit Referencing Agencies (CRAs) to determine loan decisions efficiently and effectively.

Unlike traditional credit scoring system, Quantum AI executes multiple decision flows to identify trends and patterns based on historical data and loan parameters such as loan amount, loan type, the financial institutions’ “risk appetite” to accurately generate loan predictions within seconds after a loan application is submitted with a 92.7% prediction accuracy rate.

It helps financial institutions distinguish between high default risk applicants and credit-worthy applicants.

Besides making better-informed and data backed decisions, the adoption of a flexible and scalable platform and a decoupled technology architecture could result in raising loan volumes by 100%, while reducing operational costs by 80%.

The Implications Artificial Intelligence and Beyond

The financial services industry has always adapted to the changing market climate and technology innovations to serve their customers. From the introduction of ATMs in the 1960s, card-based payments in the 1970s, the wide adoption of 24/7, mobile-based banking in the 2000s to the recent COVID-19 pandemic.

The financial services industry as a whole is now moving rapidly toward the adoption of artificial intelligence and the laggards are risked being left behind.

Kickstart Your Digital Transformation

It is time to start your digital transformation into an Artificial Intelligence powered, 100% digital lending platform.

Learn more about how Quantum AI can help your financial institution streamline your loan workflow and improve operational efficiency here.